Getting a vermont home loan might not be just like the difficult as much users imagine. While it is correct that Ny home loan business will get keeps fasten requirements having obtaining money to purchase a home, if the customers manage its homework and you will follow several effortless recommendations, financing is still designed for that it purpose. The first starting place interested in financial support for a separate York home mortgage m…

You will find a knowledgeable Nj financial rates by seeing thrift organizations, mortgage companies, industrial banking companies, loan providers, brokers, and you can borrowing unions. Thrift associations was loan providers you to definitely see most of their funds from anyone such as for instance offers and you may mortgage contacts, borrowing unions, and you may offers banking institutions. Because mortgage costs differ certainly one of loan providers, you need to consult with multiple l…

No Borrowing Loan – Zero Borrowing Mortgage: Who is For the and you can Who’s Out?

Your credit rating is the to begin with many loan providers view when you want to take out financing. It credit score will be used since the a yardstick you payday loan Fort Lupton to commonly mean to help you potential loan providers just how likely youre to blow your loan and not end up being a portion of the list of standard payers he has. Inside circumstances if you have zero credit history then your monetary establishment doesn’t have borrowing re also…

Zero Collateral Home loan – Cannot Slide Prey to No Security Lenders

Because you generate payments from the prominent harmony on your own household financial, you begin accumulating guarantee ? of course, if, of course, the property value your property hasn?t plummeted. Lately, big upheavals regarding the housing market enjoys brought about of several people to become ?underwater? employing mortgage loans. Consequently, traditional house security money ? which may be accustomed consolidate personal debt and fund family we…

Zero Equity Mortgage – Acquiring a no Guarantee Financing

A no-security mortgage is an additional title getting a premier financing-to-well worth house security financing. While it began with the new mid-to-later 90s in order for home owners so you’re able to borrow more than their homes were value, no-collateral money possess fallen out from favor with most finance companies due to the present houses and you can mortgage crisis. Yet not, a number of financial institutions still provide particularly a choice to the cash-strapped otherwise eager?precisel…

Online House Security Financing – Where to find An internet Household Collateral Mortgage

For people who individual a house and you need to borrow funds, you might sign up for an internet family collateral mortgage. You can withdraw this new security you may have and employ the cash having anything you such as for instance such as for example renovations, degree charges, financing a special car, merging expense, investments, to shop for the second domestic, happening trips and you may particularly. House collateral money promote fixed payments and you can low interest rates, and the for the…

On the web Home loan Mortgage – Words Put When Trying to get an internet Home mortgage Loan

Looking around to own a home loan on line ? home mortgage mortgage products are today region and you will lot of one’s webpages products of nearly all major financial institutions ? need increased experienced with respect to the user. Within the days gone by, a nearby banker create act as part adviser and you may region salesman undergoing obtaining a mortgage. Financial on line opportunities ? while they was simpler and also to…

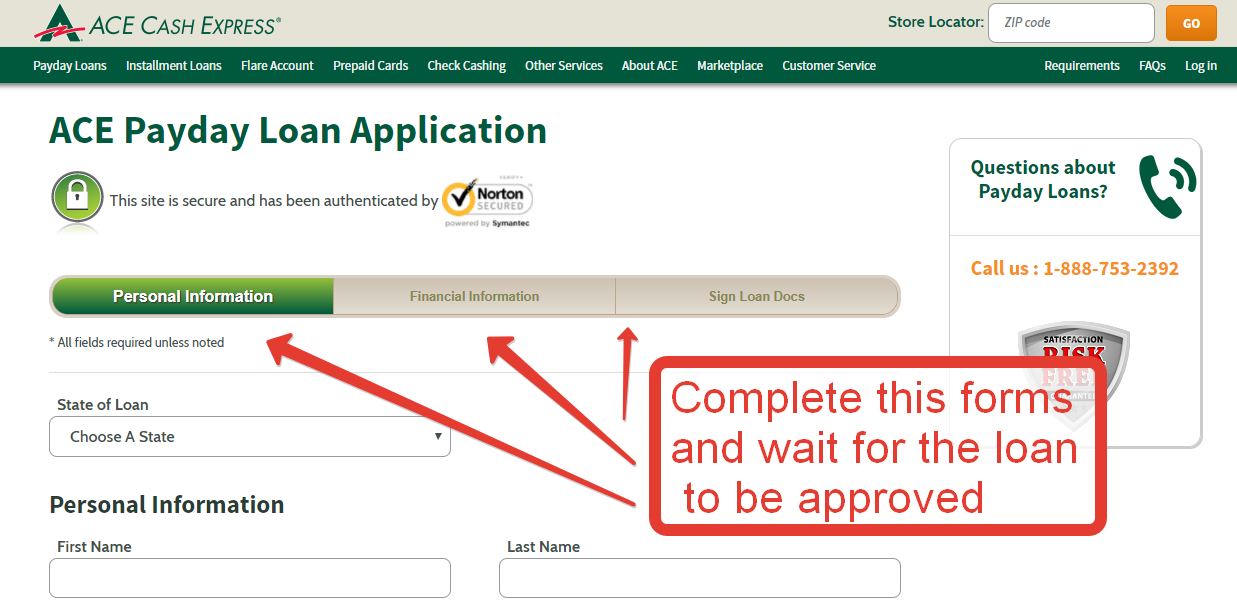

On the internet Money – How to get On line Money

Inside age of technology, of several banking companies have begun giving how to get financing online. In the place of probably a banking office and you will wishing very long hours to find out if you?re also accepted for a loan, you can certainly do the dedication from the comfort of your residence and you can wait for an answer through email or telephone call with your approval reputation. So you’re able to require a certain loan, visit your financial of preference?s webpages. If your…