Almost step three when you look at the 5 U.S. consumers put down more than 10% of your own price on the purpose of reducing mortgage payments. Of a lot get money from family members to aid.

SEATTLE The common down payment getting U.S. homeowners hit accurate documentation most of $67,five-hundred during the Summer, right up 14.8% from $58,788 a year earlier, centered on an alternate declaration in the a property broker Redfin. This was the brand new twelfth consecutive few days the new median deposit flower season over year.

The fresh almost fifteen% diving in the average deposit rather outpaced the rise within the home values, that happen to be right up cuatro% when you look at the Summer seasons over seasons. The rise will be influenced by the current sector, where large-cost, turnkey homes from inside the fashionable neighborhoods are more inclined to promote. It is also partly due to buyers putting down a top payment of your own cost while the a down payment.

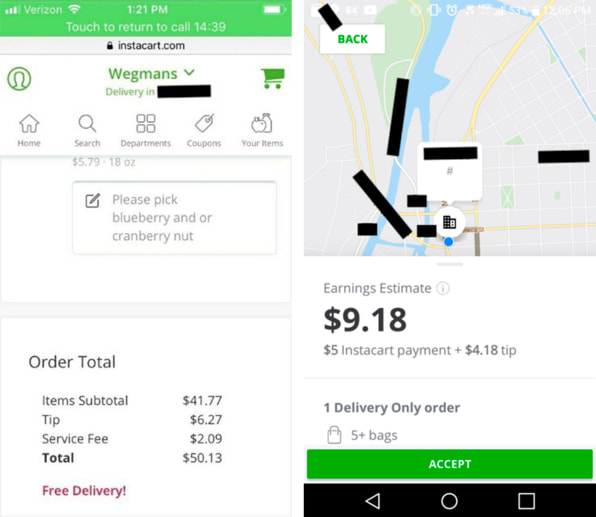

Traders are still coming in with all-dollars offers to the residential property that need to be remodeled. Antique consumers are putting off high down repayments to try to all the way down the mortgage repayment, said Annie Foushee, an excellent Redfin representative from inside the Denver. These types of customers can sometimes use the assistance of family to help you establish more they may on their own.

The common homebuyer’s deposit is actually 18.6% of your purchase price in the June, the greatest peak in the more ten years or more out of 15% annually before.

Nearly three inside the four (59.4%) homebuyers establish more than 10% of your own purchase price from inside the June, upwards from 56.6% annually prior to.

- Ascending home prices: The newest median-cost You.S. family try accurate documentation $442,525 inside Summer, right up cuatro% season over season. Large home prices needless to say result in a higher down payment, that’s a portion of the property price.

- Elevated financial cost: Homebuyers was incentivized to get down additional money upfront, and obtain reduced, when mortgage rates are highest. The brand new six.92% average mortgage rate inside the ong the highest previously 20 many years, driving customers to improve their down-payment to reduce monthly obligations.

- Customers have significantly more security: Having home prices upwards, people who sell the past assets for more than it bought it does make use of the extra collateral getting more substantial down-payment on their new home.

- All-dollars purchases make up almost a third out of domestic conversion process.

The new portion of U.S. family requests made with most of the bucks rose in order to 29.7% during the Summer, up slightly from 29.4% a year ago.

The new percentage of all of the-cash conversion process fundamentally follows the same development since rise and fall from financial pricing. When costs is actually down, the latest portion of every-cash transformation is off as well, payday loan Stafford Springs therefore the opposite holds true whenever costs rise, told you Redfin Senior Economist Sheharyar Bokhari. Which means we may start to see all-bucks orders level off a tiny given that financial pricing provides arrive at come down from recent highs.

FHA funds made up thirteen.7% out-of mortgaged U.S. house conversion process when you look at the and you will down off 14.9% a-year earlier. FHA financing provides declined because home values is located at near-number highs and you can home loan prices are nevertheless elevated, meaning fewer related consumers can pay for a property.

Antique money the most used form of depicted nearly four out of each and every four fund (79.5%) during the Summer, right up a little of 78.2% last year. Jumbo finance used for higher loan numbers and you will well-known among luxury consumers depicted 6.6% off mortgaged transformation, generally undamaged of 6.5% a year prior to.

Metro-level shows:

Inside Newark, Nj, the average advance payment popped 51.5% in order to $125,000 regarding $82,five hundred this past year 51.5% the most significant commission boost among metros Redfin assessed. Next showed up Vegas (right up forty.7% out-of $thirty-two,328 to $forty-five,500), Washington, D.C. (upwards 38.7% of $54,800 so you’re able to $76,000), The fresh Brunswick, Nj-new jersey (right up 32.7% from $93,625 in order to $124,213) and Nashville, TN (right up 32% of $46,five-hundred to $61,395).

Down repayments only dropped during the around three metros: Jacksonville, Florida (down twenty-eight.4% off $39,950 so you’re able to $twenty eight,338), Oakland, Ca ( off eleven% away from $219,000 to $195,000) and you can Tampa, Fl (off six.4% regarding $42,500 to help you $39,773).

Metros which have high/reasonable off payments, within the percent

Into the San francisco, this new average deposit was equivalent to twenty five.8% of the price the greatest among the metros Redfin reviewed. It absolutely was with San Jose, Ca (twenty five.7%) and you can Anaheim, California (25%). Deposit percentages are usually highest for the San Francisco’s San francisco on account of a higher concentration of rich owners who can manage to place a higher portion of the price off.

Deposit percent have been low in the Virginia Seashore, Va (3%) an area with a top concentration of experts having fun with Va fund with little to no downpayment followed by Detroit (6.8%), and you will Jacksonville, FL(8.6%).

Metros where most of the-cash requests are most/the very least well-known

In Western Palm Seashore, Fl, 50.4% out-of domestic commands have been made within the bucks the highest share one of many metros Redfin reviewed with Riverside, Ca (39.9%) and you may Detroit (38.9%). Every around three metros discover strong investor pastime.

All-dollars orders have been minimum prominent inside San Jose, California (18.3%), Seattle (21%) and you may Oakland (21.2%) about three more pricey metros where the median-listed domestic passes $850,000.

Metros having biggest expands/minimizes in the express of all of the-cash sales

Inside Pittsburgh, PA, twenty-eight.6% regarding family commands were made during the cash, up from 19.2% a year earlier the largest improve among metros Redfin assessed. Second appeared Brand new Brunswick, Nj (upwards out of 30.1% so you can 36.8%) and you can Newark, New jersey (upwards from twenty-five.9% to help you 30.6%).

In the Providence, RI, 23.1% from domestic orders were made from inside the dollars, off out of 33.5% a year before a low raise one of several metros Redfin examined. Next emerged Baltimore (down out of thirty six.1% to twenty six.8%) and you may Jacksonville, Florida (down off 49.2% so you’re able to 38.1%).