Do you have to apply for home financing along with your mate?

Zero, this is simply not important for one another spouses to try to get an excellent home loan together when selecting a home or refinancing their latest house.

Actually, in certain situations, which have one another partners for the home loan app may cause mortgage-related points. Eg, if an individual lover possess a minimal credit history, it could be hard to be eligible for the borrowed funds or results from inside the higher interest rates. In these instances, it could be great for exclude you to lover from the financial application.

The good news is, you can find numerous home loan applications and lower- with no-deposit fund making it more comfortable for solitary individuals in order to pick a property.

- Great things about a single candidate

- Disadvantages of just one candidate

- Companion that have good earnings but bad credit

- Refinancing rather than your wife

- One spouse towards mortgage, both to your label

- Each other spouses to your financial, only 1 towards title

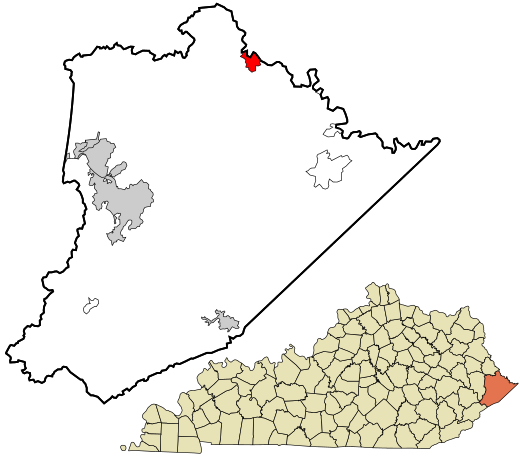

- Area assets says

- FAQ

Advantages of having one companion to the financial

- Avoiding credit history things

That is because mortgage brokers eliminate a matched credit file that have history and you can results for each and every applicant, in addition they use the lowest out of two results or even the center regarding three ratings to check on programs. The fresh get they use is known as the representative credit history.

Unfortuitously, loan providers do not average out the representative ratings to own combined programs. Rather, it forget the large credit history and you may base its render on the the low that.

This might potentially result in increased interest. Or, in case the wife or husband’s credit rating is lower enough, you’ve probably dilemmas qualifying for a financial loan at all.

Extremely mortgage people often refuse applications which have credit scores below 580. If one companion keeps a rating less than it threshold, it could be worthwhile considering an individual software.

dos. Spend less on mortgage attract

If an individual partner features passable borrowing from the bank but the most other provides outstanding borrowing from the bank, the better-credit lover you are going to envision implementing by themselves in order to safer a beneficial down home loan rate.

A few years ago, the latest Government Put aside learned mortgage costs and discovered things startling. Of over 600,000 finance analyzed, 10% might have paid off no less than 0.125% shorter insurance firms the greater number of certified loved one apply alone.

It may pay to evaluate along with your loan administrator. Such as, if a person debtor have good 699 FICO together with almost every other has a beneficial 700 FICO, they had save your self $500 into the loan costs for every single $100,000 lent on account of Federal national mortgage association charges for personal loans in Massachusetts sub-700 scores.

The main disadvantage to this technique is the sole household visitors must today be considered without the help of its partner’s money. Therefore for it to your workplace, the brand new mate to the home loan may need a top credit rating therefore the larger earnings.

Your residence can be vulnerable to getting liened or seized in some situations, particularly if your spouse possess delinquent student education loans, taxes, child assistance, otherwise a good judgments. In such cases, it is very important do something to preserve their property.

One strategy is to buy our home only on your identity. This will help safeguard ownership off potential creditors. But not, it is vital to remember that it protection may not incorporate in the event that your spouse accumulated your debt once marriage.

This also is applicable if you’re buying the lay with currency your got prior to marrying. If you purchase the house with your own best-and-separate money, you probably have to ensure that it it is a best-and-separate home.

cuatro. Express home considered

For example, if you’d like to get off your home on the people out of a previous union, its more straightforward to get it done once you don’t need to untangle the liberties of your newest spouse to get it done.