- Whether your home loan is beyond the fresh new secure-for the months, you can even check repricing or refinancing your financial to possess appeal deals.

- Aside from contrasting rates of interest, you are able to cause for the cash flow disease, full charge in it and you can assistance to the bank’s activities.

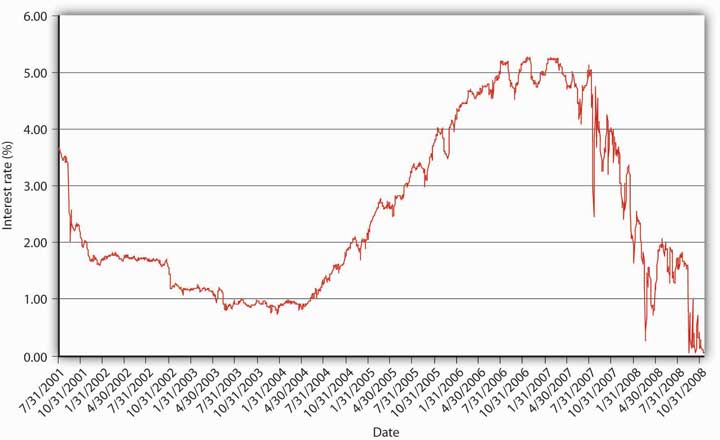

Because mortgage prices doubled from inside the 2022, residents who’re out of the lock-within the several months would-be seeking refinance or reprice their current home loan.

Will it be really such as for instance an obvious-slashed decision to choose for refinancing otherwise repricing if the current financial try in the future exiting the secure-when you look at the several months? Was interest levels the only real factor that you should be given?

Examine these dos affairs

Fundamentally, your house mortgage tenure is actually inversely proportional towards month-to-month instalments payable. To put it simply, you’ll need to repay their full home loan in the X long-time:

- A shorter period = higher month-to-month instalments, but less of your budget attract reduced

- A longer period = all the way down month-to-month instalments, however, much more complete focus paid

For some home-people, they might always offer the fresh new period of your mortgage very that they can do the monthly cashflows top.

Just how much you might use (Loan-to-Worthy of maximum) including hinges on the (the borrower’s) many years. You will have a limit implemented to your matter you could borrow, should your mortgage period plus your ages offers beyond 65. Getting combined consumers, the average years can be used. For a few Andy and you can Ling, this will seem like:

Refinance or Reprice?

Extremely property owners who will be trying to refinance otherwise reprice their mortgage need to clean out its month-to-month home loan repayments. Yet, you will find some limited differences between both.

Repricing refers to using another financial plan within this an identical financial when you find yourself refinancing describes closure your existing household mortgage membership and receiving a unique home loan with another lender.

Such as for example, after you re-finance, you visit yet another lender thus should shell out legal/valuation charge away from S$3,000 and significantly more than. When you reprice, you get a better price with your latest financial; but can have to pay a sales/management payment that could be around S$800.

There’ll additionally be early redemption fees incurred for those who exit your house mortgage for the lock-when you look at the period. The following is a listing of the typical will set you back involved which would getting useful to assist you in deciding on refinancing otherwise repricing.

Those who like to re-finance with DBS/POSB will enjoy a finances promotion getting financing levels of at the the very least S$250,000 (completed HDB apartments) and you will $five-hundred,000 (finished personal characteristics). The minimum amount borrowed for everybody from DBS home loan bundles was S$100,000.

payday loan no credit check no checking account

Residents will need to examine brand new coupons both for selection refinancing can offer dollars rebates which you can use to counterbalance the fresh legal and valuation fees. Simultaneously, your current bank can be giving repricing solutions that can give your higher deals, full.

- Suffice notice on lender.

- Create a great valuation toward property as refinanced.

- Get lawyers to complete the conveyancing into re-finance of one’s mortgage.

Other factors to take on

- Look for assistance with the bank’s items

Together with bringing a mortgage with a decent desire rate, get a hold of collaboration towards bank’s almost every other items – in which present consumers normally earn high extra attention to their discounts account, take advantage of preferential interest rates into the almost every other financial products, etc.

For many who have an excellent DBS Multiplier Account and already credit your salary, spend with an excellent DBS/POSB mastercard, taking on a home loan with DBS/POSB can add an alternative transaction classification, that probably improve bonus interest rate further.