Its especially important to understand if your loan application is eligible or disapproved if you have already generated a deposit so you can an excellent possessions designer or if you don’t want to eradicate a trending property. Ask how small he or she is into the processing the application. Some banks ensure only 5 days to produce a decision. Usually, it entails per week. Be skeptical from timely operating claims that can in fact capture weeks rather than weeks, claims Bobby.

What you need will be to have enough time to put on with an alternate financial if the application gets disapproved. To go on the brand new safe, Alex claims that essentially, you need to sign up for the borrowed funds very first and you may safer recognition out of the lending company just before paying any money just like the there is no-one to assuring you away from how much time it will take a lender so you’re able to process the loan or if it will also become approved at all. Certain financial institutions take more time than normal to approve a loan since the some complications with the newest identity of equity assets.

Anyone else make discounts available otherwise bucks backs because the a restricted promo

In addition, you want to make yes it is easy and you can simpler having you to definitely shell out their amortization. Query just how and where you are able to shell out. Particular finance companies focus on their wider branch system, in order to shell out any kind of time of its branches. not, extremely financial institutions allow you to spend having fun with post-old inspections otherwise explore its automated debit plan.

The whole process of making an application for a loan really can end $500 loan with poor credit in Bakerhill up being a demanding feel. You could work on a financial that will give-keep your or stick with one which cannot hound your in the event the you will be sometimes late which have money. Loan officials who are polite, diligent, and you can flexible can also be encourage your even though you will get a good down rate in other places. Specific banking companies submit and pick right up documents from the home or office. In addition, you have to tune the loan balance and you may costs because of the cellular telephone and online. Regrettably, you don’t get to inquire about exactly how the customer support is actually. Yes, you could ask other people. However it is something you can only just feel.

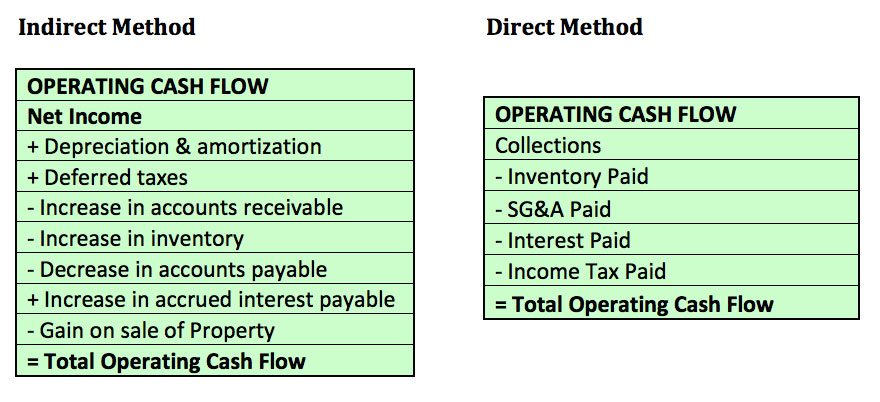

A keen amortization schedule try a desk describing your own periodic financing payments

5. How can you compute my amortization agenda? Query the bank if this even offers each other upright-line and you will declining-harmony selection. Which have upright-line, your own monthly payments is repaired. With ortization in the 1st lifetime but since your loan balance-the basis for this new month-to-month attention-refuses from the identity, your payments along with decrease because you close to the avoid of your own label.

nine. Are you experiencing a preexisting otherwise up coming promo I must learn about? Certain finance companies dangle freebies or the opportunity to subscribe raffles and you will profit huge awards. Some waive application and you may appraisal fees. Many throw-in an excellent pre-accepted mastercard otherwise package good pre-licensed device loan within a preferred rate and you will longer terminology. There are also promos which can go back all of your dominant immediately following the conclusion the mortgage term. At this time, certain financial institutions often reduce your rates the greater their put harmony is through all of them. Always query what more you can aquire. But don’t get this to your primary base. Bobby Disini, vice president and you may lead of PSBank’s Mortgage Financial Office, cautions, Avoid falling for propositions in place of intrinsic really worth such as for example instant freebies one to make an effort to cover up exactly what really matters for a loan borrower such as for instance low interest rates, punctual processing, and more reasonable mortgage conditions. ten. Why must We obtain away from you? Okay, dont ask it bluntly, you need appreciate this are a great borrower’s sector, exactly what because of so many contending lenders attacking more your company. So any competitive advantage are working to your benefit.