Financing a cellular family boasts its group of factors, for instance the home’s years, foundation, and you will taxation updates. In lieu of antique site-mainly based homes, and this usually see within the really worth through the years, mobile home tend to depreciate, comparable to car. So it decline can make pre-1976 mobile a home loan particularly challenging and sometimes requires alternative solutions.

not, there is certainly a gold lining: for individuals who currently very own the latest residential property, you’re capable safer mobile a home loan because of a unsecured loan otherwise a good chattel financing in place of a mortgage. Thank goodness, specific cellular household lenders focus on each other residential a residential property and personal possessions, allowing one to obtain the cellular home loans you would like.

- Mobile vs are formulated residential property

- Cellular home financing criteria

- Cellular a mortgage options

- Cellular home loan providers

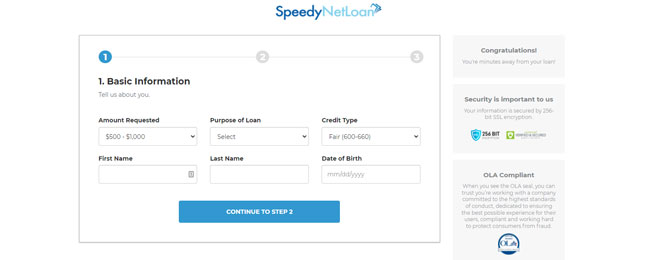

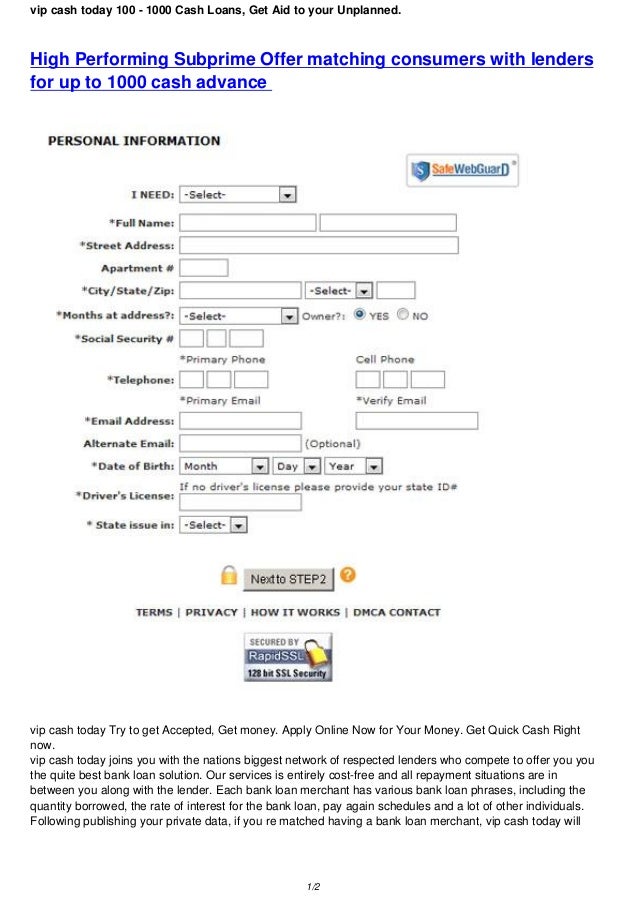

- Application for the loan processes

- FAQ

The essential difference between mobile and you will are designed belongings

cash advance” width=”450″ align=”left”>

cash advance” width=”450″ align=”left”>

Cellular homes and you will are made house is both sort of prefabricated formations, but you can find key differences between all of them that will apply to financing options.

Mobile homes

A mobile home refers to a factory-centered family constructed just before Summer fifteen, 1976, if the U.S. Service of Houses and you may Urban Creativity (HUD) delivered the fresh security standards. These house were created with the a permanent chassis which have rims, causing them to potentially moveable, as they are usually listed in a fixed place.

Having said that, a manufactured house is a factory-depending home developed immediately $600 online payday loan low interest Connecticut following Summer fifteen, 1976, adhering to new HUD Code’s tight defense and you may build standards. Like mobile homes, are manufactured land are available with the a permanent body, but they are built to end up being directed to help you an online site and you can mounted on a temporary or permanent base.

Mobile home financing conditions

Whenever trying resource to have a put mobile house, it is very important understand the certain criteria you’ll want to see. Whether you are looking for a cellular mortgage loan to own a house into land otherwise funding on home only, there are many you should make sure.

Loan providers typically need a high downpayment having an effective used cellular house than the a classic household otherwise a more recent were created household.

Prepare yourself and make a down-payment of at least ten20% of cost. On top of that, a credit score out-of 580 or more are needed to be eligible for cellular home financing, however some loan providers could have large criteria. A much better credit history helps you safer more advantageous focus prices, mortgage terms and conditions, and more in balance monthly premiums.

Many years and condition

Loan providers will often have certain decades and you will condition conditions on mobile home they finance. Particular loan providers may not render finance getting residential property older than 20 otherwise 25 years, while others may require a thorough assessment to evaluate the new residence’s position and ensure they fits shelter standards. Anticipate to bring detailed information regarding property’s age and you can condition whenever making an application for cellular a home loan.

Cellular home financing with the yourself-owned land

While you are seeking financial institutions one to money mobile home having land, you really have so much more options available. Lenders can be significantly more willing to finance the home because real estate if it is permanently connected so you’re able to a charity on your own possessions.

However, in case the house is towards the hired homes or in a mobile house park, your own investment solutions can be far more limited.

Investment to your house only

Whenever trying cellular family loan providers for good utilized cellular household in place of belongings, you will have to mention official lending products. Of several old-fashioned mortgage companies do not provide financing getting mobile property that aren’t forever attached to help you property, because they’re thought private assets in lieu of a residential property.

Mobile a home loan choice

In terms of financial support a mobile home, it is very important note that traditional loans supported by Fannie mae and Freddie Mac are not readily available for correct mobile homes. Furthermore, government-supported mortgages, such as for instance FHA financing, Virtual assistant fund, and you can USDA finance, do not continue to help you mobile home financing.