Luck The fresh new Government Reserve’s current decision to acquire home loan ties before the economy recovers has made household credit more appealing than simply it has been in many years. The latest spread ranging from exactly what it can cost you to pay for a mortgage and you will what borrowers indeed shell out is nearly 3 times due to the fact higher as ever. Therefore it is perhaps no surprise this 1 of very first agencies to help you hurry into the it finances-occupied fun residence is going from the former managers of your extremely notorious subprime financial of point in time you to definitely triggered brand new overall economy.

Towards the Brandt, Chamberlain states the latest professional oversaw 700 to 800 team from the Countrywide, along with one to around three group whoever limited obligations were to need fund to the VIP product

Past times, PennyMac (PMT), a monetary institution run nearly totally from the alumni out of Countrywide Monetary, started the earliest merchandising branch. The firm wants to hire possibly 100 employees to possess any office, that’s into the Pasadena, California, and additionally financing officers and underwriters.

To lead the office, PennyMac features tapped Stephen Brandt, which, based on an excellent Congressional report put-out in . This new statement learned that Brandt’s former product passed out a huge selection of sweetheart money so you’re able to people in Congress, their staffs or other government group. One of the several thrusts of the section, with regards to the report, that was nicknamed after Countrywide’s former President, Angelo Mozilo, were to ease anti-predatory financing statutes.

And when PennyMac funds men and women fund $step 1

There is certainly free cash on the dining table and you don’t need to functions one to hard to get they, specifically if you certainly are the former professionals of Countrywide, claims Michael Widner, an expert just who covers PennyMac from the brokerage firm Stifel Nicolaus. You’ve done so before.

PennyMac has been in existence for several many years. But once it had been were only available in 2008 by the a dozen previous professionals out-of Countrywide, plus Stanford Kurland, who was Countrywide’s No. dos manager before you leave when you look at the 2006, PennyMac’s said business strategy was to pick upwards delinquent mortgage loans at a lower price, promote variations and also make some funds in the process.

Previously 12 months, even when, PennyMac provides morphed to your something that way more resembles Countrywide. In current trader presentations, Kurland and other PennyMac executives provides spoke in the organization’s equipment you to definitely funds the latest mortgage loans made by additional agents and brief banking institutions. The unit premiered a year ago, nowadays makes up about in the a third of your organizations earnings.

PennyMac might have been a lot more rigorous-lipped in the the head credit process, that is still relatively small. A lot of experts which proceed with the providers have been unaware of it. PennyMac spokesman Kevin Chamberlain, and you can Countrywide alumni, says PennyMac’s merchandising process is mostly about refinancing outstanding individuals whose mortgage loans had been obtained by PennyMac towards the affordable loans. According to him the fresh Pasadena work environment is not suitable walk-ins.

In addition, Chamberlain says head credit is not an integral part of PennyMac’s investor presentations while the division is part of the business’s individual functions, not its in public exchanged providers.

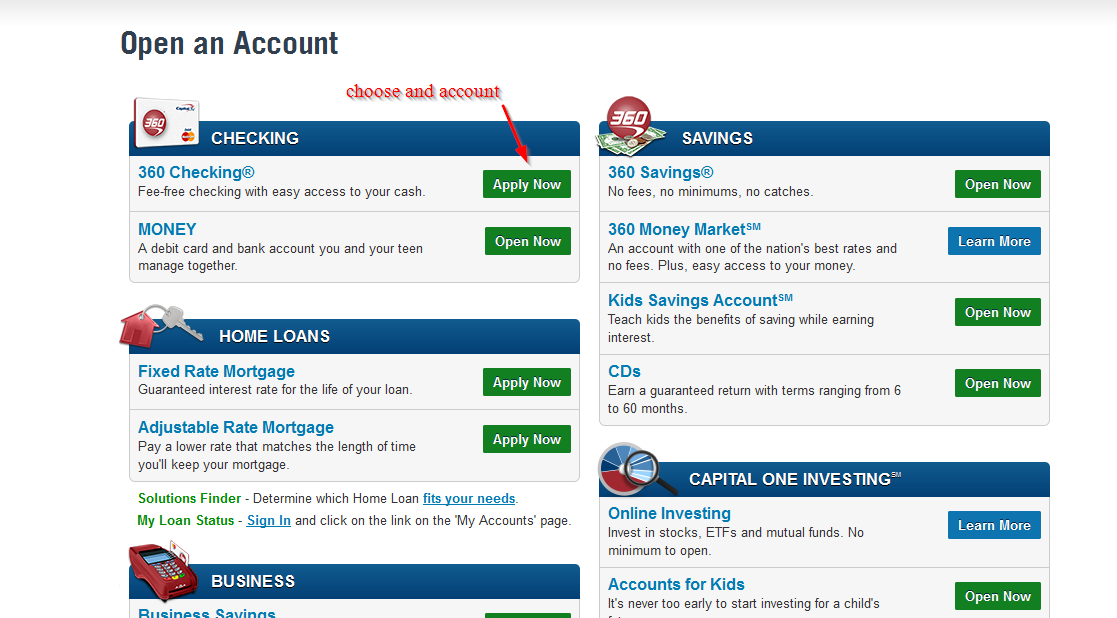

PennyMac, even if, will not appear to be hiding the lending surgery regarding prospective customers. The company is utilizing direct-mail to help you solicit users. The business’s webpages promotes new home loans with cost as reduced since step 3.5%, and has a keen 800-number to call. The one who answers states the guy works best for https://clickcashadvance.com/personal-loans-sc/ PennyMac.

PennyMac’s strange business structure keeps worried particular Wall Path experts. PennyMac works a general public home loan REIT, yet not all organizations business and you will winnings see the brand new REIT. By way of example, PennyMac’s mortgage REIT is not approved to offer fund so you can Ginnie Mae, which is the authorities entity one to backs FHA finance. six mil from inside the July and August by yourself the public REIT passes all of them with each other so you can a private department off the business, that is possessed and you will operate from the PennyMac’s executives as well as a couple of exterior traders, house manager Blackrock and personal security business Highfields Resource. The newest REIT can make a tiny payment, only 0.03%, into the individuals sale therefore the personal organization pouches the others, which is the almost all the gains.