Richard Stevens was a working a property trader with over 8 several years of world sense. The guy focuses on evaluating topics that interest a residential property dealers and you may strengthening calculators that will help possessions dealers see the expected can cost you and you will productivity whenever carrying out a house marketing.

Figuring just how much house you can afford is fairly quick if you just want a basic imagine centered on your current income. For example, you to definitely small code flash is always to redouble your annual paycheck of the 2.5 (or step 3 when you yourself have a good credit score). That said, you may also reach a far more perfect guess, with a couple easy financial obligation-to-income rates.

The reason for this post is in order to definition your debt-to-earnings percentages that all United states finance companies play with whenever figuring your demanded financial amount. I will be having fun with multiple affiliate-friendly charts and you may advice to simply help harden a few tips.

Short Rule of thumb: Multiply your Yearly Salary From the dos.5 otherwise step 3

The quickest way to work out how far home you might pay for is to re-double your annual pre-tax paycheck by the dos.5 or step 3. If you would like an old-fashioned estimate, play with dos.5. If you would like a very aggressive estimate, play with 3. You will find how simple it is to accomplish if you take an easy go through the dining table lower than.

Using this type of great way enables you to quickly workout a beneficial potential financial matter based on your current paycheck. Definitely additional factors have a tendency to influence the past bond matter https://paydayloancolorado.net/comanche-creek/, but this is actually the place to start while you are still simply browsing for properties.

Including, it’s well worth bringing up the current get rid of for the rates of interest (owed to some extent in order to Covid-19), means that multiplying by 3 (plus highest multiples) happens to be way more practical to have American’s having a reliable income.

The more Precise Approach: Making use of the Laws

Again, this really is better to have demostrated with a desk, for getting a feel for just what particular income supports are able.

Please note, this new desk more than assumes a good 5% put towards the family. And, you may find that total obligations (mortgage + other bills) is much more than the newest dining table indicates. If that is possible, it does cure how much house you really can afford and your month-to-month homeloan payment.

The team from Wise Asset enjoys described the laws quite nicely. In essence for every single pre-tax money you get each month, you ought to invest no more than 36 cents to repaying your financial, college loans, personal credit card debt, and the like.

Are you willing to Split The new Code?

Since the rule is an established tip, this isn’t an immutable laws you to banks try obliged so you’re able to follow. It’s simpler to consider the full financial obligation rule since initial step into the a sliding-scale.

When you yourself have a dismal credit get and several current obligations, finance companies might view you given that a premier-chance personal and you will give you a thread that is less than 28% of your pre-income tax paycheck.

However, for those who have no vehicle payment, lowest beginner financial obligation, and you will a good credit score, you could naturally qualify for a home loan which is more than 28% of your own pre-tax paycheck.

Items that will decrease your limit financial

- High car payment

- High student loan debt

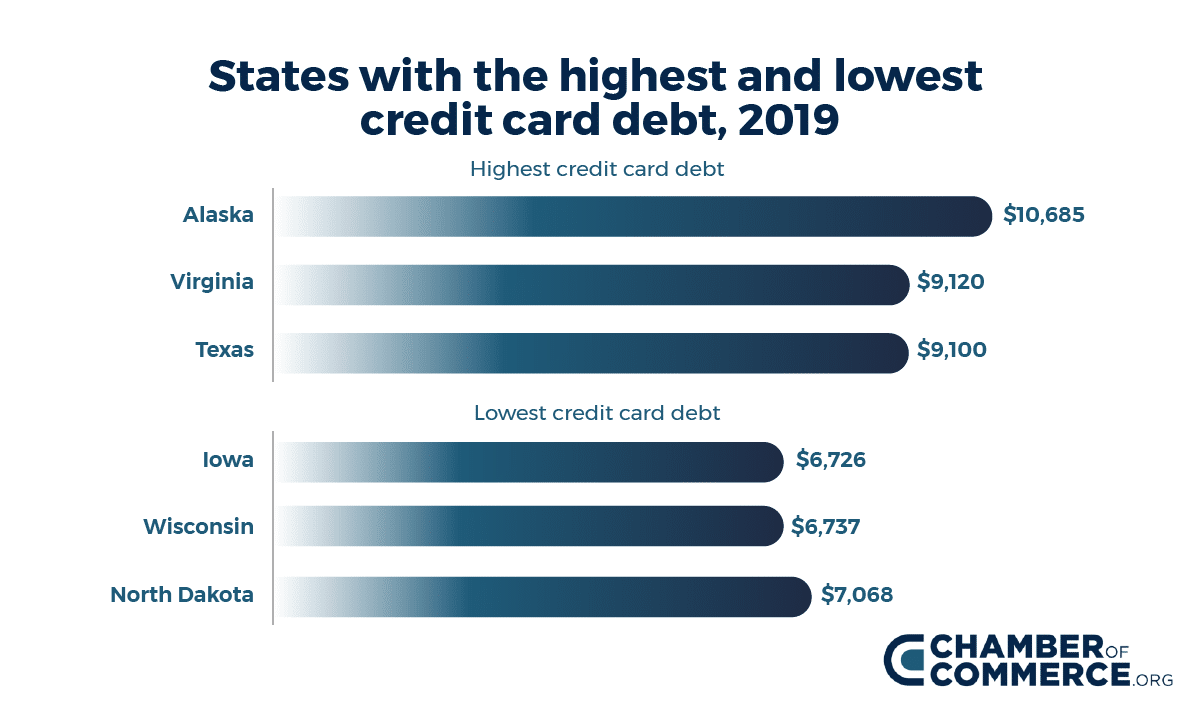

- Large credit card debt

- Lower income

- Bad credit Score

Facts that improve your limit financial

- Brief if any car repayment

- In balance student loan

- Little to no credit debt

- Large Money

- A good credit score Get

What is Debt-To-Earnings Proportion?

Debt-to-income (DTI) proportion ‘s the part of their pre-taxation earnings that is allocated to repaying loans. Debt-to-earnings is the basis of your laws and is the latest first determinant out-of how much household you really can afford, based on your money.