To have Amit, purchasing a property was one of the important essentials regarding lives. To make their dream become a reality, the guy decided to go to possess an bad credit loan in Yuma established home loan available of the a famous lender inside the Asia. Considering the persistent dedication one to Amit had installed, he was in the end able to get home financing that had a lower life expectancy interest rate. But not, he didn’t understand one destroyed even several EMIs you may create him substitute the list of defaulters. Whenever their father got unwell, he’d to pay tons of money into the medical expense and this drained regarding his discounts. We, just who end up being mortgage defaulters, of course features particular choice in the their discretion getting approaching for example a great disease.

Organisations such as for instance CIBIL battle problematic for brand new betterment from financial consumers. Not only are you able to rating done information about mortgage payment norms, also all your valuable credit rating which have an individual simply click. People who have already become defaulters can also attract into improving the credit rating so they really discuss towards bank for the a better way. A default takes place when a person is not able to result in the monthly obligations several times.

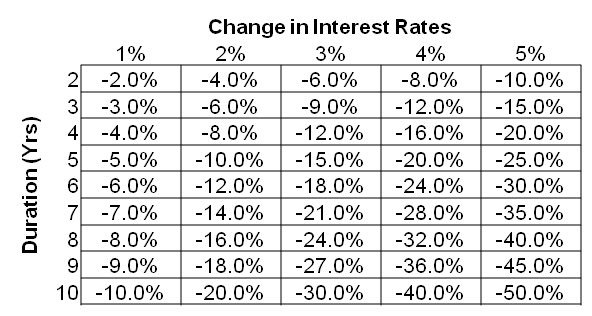

All lender offers different rates; which, you really need to find a loan having a significant total prices to be able to pay it back easily. Provides a close look on interest rates available from the a number of preferred Indian finance companies.

You must know that it is perhaps not the end of the street and there is different things that you may possibly carry out besides indulging from inside the a dialogue into bank to get the state down

Your own financial establishment wouldn’t consider one end up being a mortgage defaulter if you have skipped just a single commission. But not, for individuals who repeat an identical error for the next dos otherwise 3 installments, then your bank will be sending your a notice and that acts as a note to make this new EMIs. If you fail to bring a hobby, an appropriate see is sent to you personally. The time has come when you’ll be considered to be a loan defaulter. The very last choice that lender have is to recover the brand new property away from you. The method to take across the household constantly initiate shortly after step 3 in order to 5 months if courtroom see has been delivered to an effective defaulter.

Finance companies on their own don’t want to grab your property and therefore discussion you are going to show to be a great choice but if you’ve become that loan defaulter. Plan a meeting with the financial institution bodies and then try to generate them understand this precisely you’ve not managed to make the costs in the long run. Require particular feasible solution that’ll help you plus the financial, each other. Loan foreclosure, also, is a great option when you find yourself prepared to promote your house.

It is an effective modifications alternative you to positives not simply the lender nevertheless borrower as well. In case your lender finds your situation to get genuine, they will certainly invest in reschedule your loan title. He could be merely going to offer the loan period so that your own month-to-month EMI costs cure notably. This will help to obtaining quick relief from the burden regarding cost. This process is much better than simply pre-percentage because it scarcely possess people processing commission.

A debtor could even ask the newest financial institution so you can defer a beneficial couples month-to-month EMIs however, if he is wanting a large rise on earnings of their business otherwise maturity of a few financial funds. not, discover some penalty which you yourself can have to sustain should you choose that one.

Banks usually agree with a-one-time payment and that means you you are going to envision repaying the entire count at the same time. Yet not, once the a borrower, you need to ask the lending company to help you waiver out-of certain charge. If the monetary condition is quite bad, you can file for bankruptcy since it can help you take away the financial relationship.

If your possibilities mentioned above neglect to be right for you, the financial institution often move ahead with the option of repossession off your assets. New recuperation process is carried out legally and you may a 60 day notice is sent to you in order to get some date to repay your bank account. A demand hands see is distributed for your requirements immediately after two months if you fail to make money. Depending on it observe, the latest borrower must hand over the home files towards the bank.

Preferably, try to get mortgage restructured towards stronger terminology

Always keep in mind that against a posture strongly can help you rating from it. Grab each step very carefully to recover from the standard state. Rating crucial details about financial non-payments by the evaluating on