Defaulting on the home loan cost doesn’t only damage the credit rating but also helps it be difficult for one acquire cash in the future regarding banking institutions and other financial institutions. When you take financing toward a property, you have to pay back extent including the principal and you may demand for Equated Monthly Instalments (EMIs). Their relationship with the lending company remains undamaged right until you continue to shell out their EMIs punctually.

Every so often, activities be hard, and we are not able to meet our monetary debts, especially in situations instance a career crises or death of pay due so you can real issues or disability. To quit fee non-payments of the mortgage consumers, brand new Reserve Financial off India gave a 6 months moratorium for everybody name financing. Go through the post and watch what will happen for folks who default on your personal loans for bad credit New Hampshire mortgage payments and exactly how you could handle the trouble really.

What takes place If you can’t Pay-off Your property Financing?

Judge Effects: If you miss out on paying up to 3 of your own financial installment payments, the bank could possibly get seize your property. not, there are lots of tips regarding like circumstances. They don’t frustrate you if you default towards and make the original payment of your house financing repayment. Actually on the 2nd overlooked fees, the banks just upload an indication. not, for those who miss out on expenses about three successive installment payments of your own home loan fees, the lending company provides you with an appropriate notice requesting the mortgage cost and you may begins with brand new healing process.

House since a keen NPA: Lacking around three consecutive mortgage fees installment payments produces your own bank state your residence because the a low-undertaking asset. Such as for example possessions do not generate any income to have lenders and you can provoke them to get after that procedures for cash recovery.

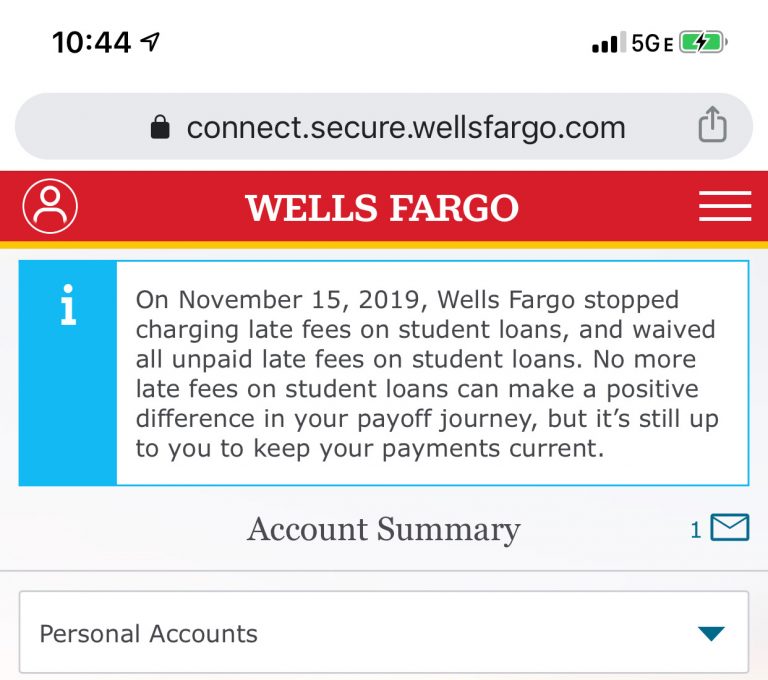

Expensive EMI Percentage to the Then Day: If you miss an EMI fee, the financial institution fees later charge, usually dos-3% of EMI amount. Like, should you have a keen EMI regarding Rs. 5000 and you fail to shell out, you’re levied a late commission away from Rs. 150 (3% off 5000). Not only that, however your interest may also improve, thus the long run EMIs might be more expensive to pay away from. So, in the event the rate of interest develops by the 0.25%, in place of Rupees 5000, the next EMI might be Rupees 5060.

“Just like the all the lenders is actually safeguarded of the a home loan of your advantage, the financial institution/financial institution can also be initiate legal proceeding to enforce the loan. They could sell the newest investment once tying they thanks to market otherwise personal pact. Capable take action their rights beneath the Recuperation of Bills Due to Banking companies and you can Financial institutions Act, 1993 and/or SARFAESI Operate. Aforementioned as being the most expeditious answer,” states Sagar Kadam, Lover – DSK Legal.

What are the results If you can’t Pay Your house Loan | Financial Cost Activities

Taking over of Property: Finance companies give you on a few alot more weeks to expend the overlooked financing instalments shortly after sending a legal observe. For individuals who default on the same, the financial institution will be sending the auction find into projected property value your home. The financial institution proceeds for the auction formalities if you do not start making the house loan repayment until the market go out, we.elizabeth. one month immediately after finding this new public auction notice. In duration of this type of six months, you could potentially contact the bank when and try to create a settlement by cleaning your own fees.

Influence on Cibil / Credit rating: Something different one to gets impacted by perhaps not and also make fast financial payments is your credit history. To own consumers lost its loan money, banking institutions send a terrible monetary report to the authorities contrasting the credit get. Extremely banks and other monetary lenders read your credit score to test how you take control of your earnings before approving people of applications. Without a favorable credit history, it is sometimes complicated to help you borrow cash away from any lender for the the future.