Really loans does not disappear once you perish. Who will get accountable for this will depend on your condition and you can just what sorts of personal debt its.

In this article, you’ll learn what will happen to financial obligation after you perish and how life insurance coverage can protect your loved ones regarding inheriting this personal debt.

And additionally the money you owe, its vital to plan for your electronic property before you perish. Understand what to think and exactly why it’s important.

What will happen on my Obligations When i Die?

- Protected personal debt: needs an asset as guarantee. For many who default with the payment, the financial institution is also seize the brand new resource to recoup will cost you. Examples include financial and you can automobile financing.

- Consumer debt: has no need for equity that is in line with the borrower’s creditworthiness. If you can’t build money, focus and costs accumulate. The financial institution will get sooner transform it off to an obligations enthusiast that will make multiple attempts to gather commission from you. For example credit debt and medical expense.

If you have debt, whether covered otherwise unsecured, when you perish, it typically becomes the duty of your home. But that doesn’t mean the ones you love are entirely off of the hook up.

- Your estate is actually appreciated, and you will one liabilities are subtracted from the estate’s value, in addition to financial obligation.

- Predicated on county law, the latest probate courtroom establishes who will get accountable for the estate’s debt.

- Probate court approves a property executor to spend debts and you may distributed assets so you’re able to heirs.

- People co-closed personal debt, such as for example private college loans, gets the duty of the thriving cosigner.

- One jointly-owned personal debt, particularly a couple partners getting property, becomes the responsibility of your own enduring owner.

- Personal debt obtained when you’re partnered in the a community-assets state gets the responsibility of your own surviving companion.

- Debt had only because of the inactive was repaid using payday loan Broomtown possessions about home.

Preferred Brand of Obligations and how They are Passed on

12 months over season, mediocre personal debt in the us increases. Whenever we accept it financial obligation, do not keeps our very own demise at heart. However can’t say for sure just what will happen tomorrow.

If you are married and you will residing in a community-assets condition (AZ, California, ID, La, NV, NM, Texas, WA, WI), one debt you and get while in the matrimony becomes the wife or husband’s responsibility when your die, also personal loans.

Certain community-assets says enables you to officially split possessions having a new Possessions Agreement thus loan providers cannot been following the enduring partner to possess payment. Normally carried out in writing.

Only one type of debt is actually discharged upon your own death: government student loans. After proof of dying was registered, your debt was deleted.

Changes in income tax rules have also eliminated fees on the released beginner loan obligations. Previously, one student loan financial obligation terminated on account of dying or handicap are nonexempt.

Private figuratively speaking are maybe not forgiven. Such financing have a tendency to want a beneficial co-signer. That person becomes responsible for repaying the mortgage for individuals who die.

What the results are with a home collateral loan is like a great real estate loan. Once you perish, among around three the unexpected happens to your financing:

In the event it mortgage is actually cosigned, see your face is responsible for the borrowed funds. If there’s no co-signer, heirs involve some possibilities.

Credit card issuers will try locate paid down out of your home when you pass away. If the no cash try kept on your own home to repay the debt, the credit credit companies won’t get paid.

In the event the bank card is actually cosigned, the fresh new co-signer must pay the bill. Licensed charge card users commonly responsible for the bill, even so they can’t utilize the cards.

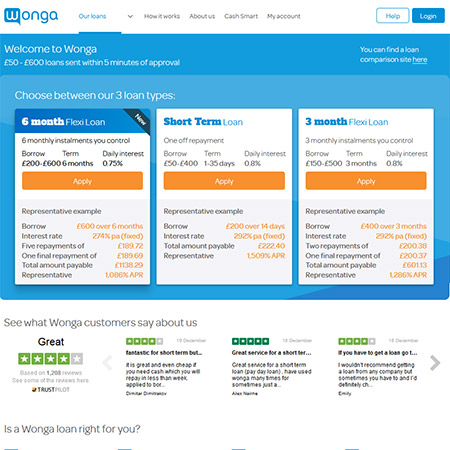

Lenders usually mountain to purchase borrowing insurance policies when taking away a good unsecured loan. (Additionally, it may be offered having handmade cards and you can vehicles otherwise mortgage brokers.)

Borrowing insurance rates pays right back the lending company if you fail to. If you decide to die along with borrowing insurance rates, the lending company will get repaid. For many who perish in the place of credit insurance coverage-your guessed it-the lender can make a declare on your house.

Once again, i advocate to own label insurance coverage more than credit insurance. Title insurance rates could be more prices-productive than borrowing from the bank insurance coverage which can be far better on the adored of those.